Inflation

Inflation is a hot topic nowadays. Layman definition of inflation can be, “too much money chasing too few goods”. When almost everyone has more money than before, then money slightly loses its value and prices of goods go up. That’s inflation.

Inflation reached an all-time high of 31 years at 6.2% in October 2021(update: inflation in November 2021 was at 6.8%,in December 2021 it reached to 7% and in January 2022 it was at 7.5%). Federal Reserve System i.e. federal bank of US has created(i.e. printed) almost 40% of all the circulating money in the economy. That’s huge.

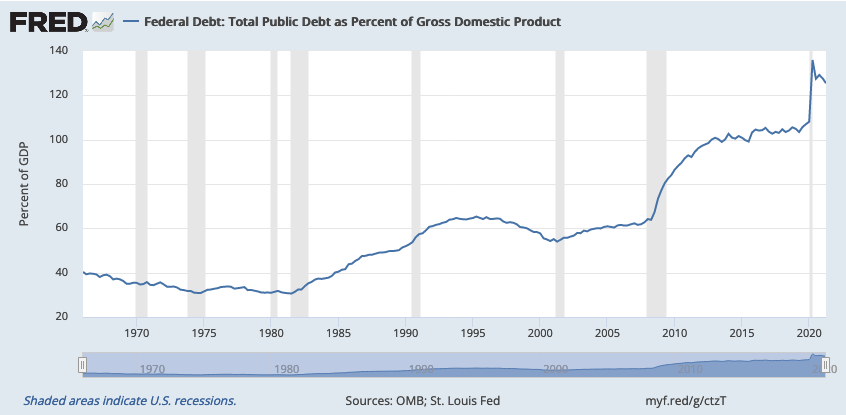

Here’s a bigger problem. The US government has taken huge debts in the last year that debt to GDP ratio has reached ~125%!

Why is high debt a problem? Right now, interest rates are low, so the government does not have to pay a lot of interest on that massive debt. But once the interest rates rise, which it will eventually, the US government has to pay that massive interest to the lenders.

Why will interest rates rise eventually? Right now, interest rates are low because the government wants to make it easier to take loans for people and businesses, so that they can spend more and eventually the economy will get back to pre-covid level. When money changes hands quickly, the economy thrives. When everybody becomes fearful of spending, the economy throttles to near death. That’s why it’s important for the government to incentivise spending. And to do that, they have to keep the interest rates low.

But, obviously they can’t keep the interest rates low forever. Otherwise, people will take so much debt and will have so much money that inflation will go out of control. Because higher interest rates mean higher borrowing costs, and people will eventually start spending less, which will bring inflation under control.

So, can you see the trap here? If the Fed keeps the interest rates low forever, inflation will go out of control. And if they increase the interest rates, they have to pay massive interest payments on that gigantic debt of ~$30 trillion!

World’s Reserve Currency

The U.S. dollar was officially crowned the world’s reserve currency and was backed by the world’s largest gold reserves thanks to the Bretton Woods Agreement. That means, instead of gold reserves, other countries accumulated reserves of U.S. dollars.

Another major reason behind that is, oil can only be bought using U.S. dollar(aka petrodollars) - and every country needs oil. So, every country must need to have U.S. dollar in their reserves. That’s a massive advantage for the USA.

So, why can’t the US print money to pay off debt? Well, printing money to pay off the debt would make inflation worse.

Why can the U.S. confidently “print money”, but other countries cannot(necessarily) do the same? Because the U.S. dollar is the world’s reserve currency. In other words, most countries and companies from other countries usually need to transact in U.S. dollars, making them exposed to the value of their currency relative to U.S. dollars. The United States and the Fed in particular, doesn’t face this problem.

But leveraging the fact that the U.S. dollar is the world’s reserve currency again and again, the USA can’t avoid problems forever. As it will degrade the value of the U.S. dollar and the status of global reserve currency will progressively decline.

Stock Markets and Crypto Markets at All Time Highs

In the high inflationary times, prices of almost everything rises. And at the same time, if interest rates are at the lowest times, keeping money in the bank is a very bad move. If inflation rate is higher than interest rate, you are actually losing money by keeping it in your bank accounts. Because prices of goods will rise faster than your money rises in the bank account because of interest.

Now, people need to invest their money somewhere right? They can’t keep their money in bank accounts. So, most likely they will invest in mutual funds and stock markets. And when almost everyone takes money from their money from their banks and puts it in the stock market what happens? Stock market rises at an even faster rate.

That’s why the US stock market and crypto markets are hitting all-time highs in recent days and months. There’s no alternative way to make better returns which beats inflation, than the stock market and crypto.

But here’s the problem - underlying companies are not growing at the same pace as their stock price is rising. So, chances are higher that, sometimes this high stock prices may come down to its actual values. But people are saying stock market prices are higher from 2017 itself, and it has not come down yet as of November 2021.

I really don’t know what will happen from now. Everything is hitting all-time highs - stock(NASDAQ and S&P) markets, crypto markets, inflation, government’s debt, real estate prices, company’s(i.e. startups) private valuations - all of them are at their all-time highs!

So, we really need to ask this question to ourselves: are these all-time highs because everything is actually this much greater, or it’s just distorted? Human greed certainly plays a role in inflating these bubbles.

It’s really going to be interesting to see what happens in the future, so keep your popcorn ready for this mega-show!